Retiring out of state? We are licensed for reverse mortgages in 17 states

Between 2007 and 2016 16 million residents moved out of California; many of whom were seniors retiring to different states. The HECM for purchase program allows seniors to take the equity from their current home sale and purchase a new home with a large down payment. They move in and…

HECM Reverse Mortgage fees have dropped

The Home Equity Conversion Mortgage (HECM Reverse Mortgage) program was signed into law by President Reagan in February 1988. Prior to this date, this was a bank run program and they had the power to foreclose on homeowners if they ran out of equity. Unfortunately, some seniors ended up homeless…

Best Savings On Prescription Drugs

As outpatient prescription drugs are not covered by Medicare, those costs can be a severe drain on income in retirement. Some estimates have seniors spending about 3.1% of their annual income, just to cover medications. Erin Fox, who directs the Drug Information Center at the University of Utah explains: “The…

Downsize to apartment or smaller home in retirement? Look back 15 years to anticipate the future

I recently met with “Helen” as she was in the process of selling her home she had purchased in LA County 30 years ago. Her home value went up a whopping $600,000 of which she will be able to keep about $300,000 after paying off mortgage and realtor fees. Helen…

Journal of Financial Planning: During market drops, using this strategy extends retirement survival by decades

For retirees with substantial investments in the stock market, February was a scary ride. On the 5th investors held their collective breath as the Dow Jones Average free fell almost 1,600 points; marking the biggest single-day point drop in stock market history. For those living on their stock market returns, February…

You may qualify for 6% compound growth on your Reverse Mortgage Line of Credit!

You are of Reverse Mortgage (RM) age but, you don’t need the money. You should get a RM anyway. There is a powerful tool in a RM called a Line of Credit Growth Rate. On the HECM(Home Equity Conversion Mortgage) Annual program with an initial rate of 4.35% (plus monthly…

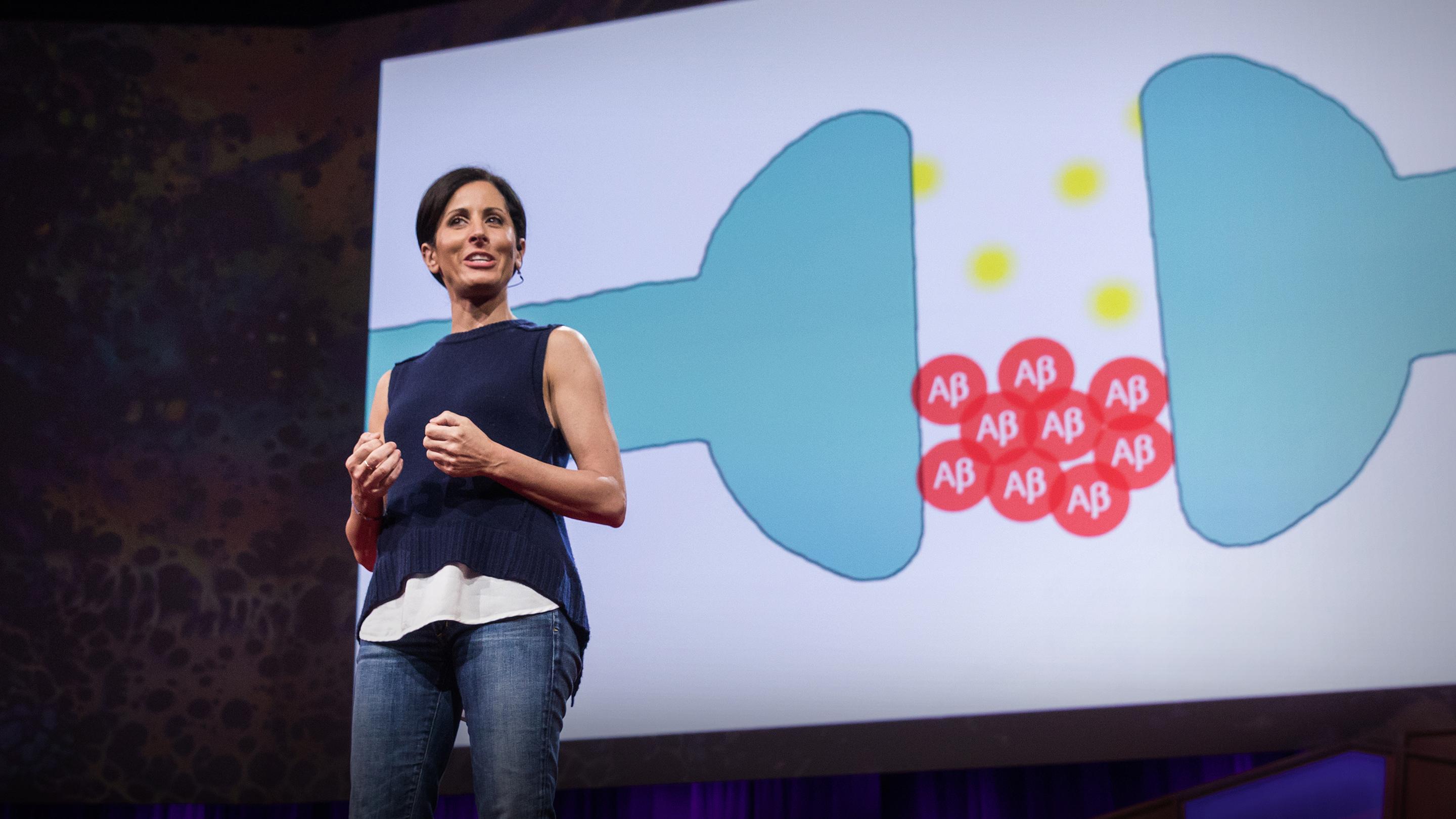

What you can do to prevent Alzheimer’s

Perhaps you are always searching for your keys, or you go into a room and forget why you walked in, this scenario has happened to all of us, but does it mean you are at risk for Alzheimer’s? Are there any medicines being developed to prevent or cure this disease? …