Early on in the pandemic the Federal Reserve (FR) slashed the Federal funds rate (FFR) (the rate it charges to banks for overnight borrowing) to stimulate the economy. This was to combat the 22 million Americans that could not work and were unemployed. This huge drop in FFR has an indirect effect on mortgage rates and helped drop those rates as well. Lower mortgage rates allowed some buyers to afford to pay much more for homes as lower rates meant lower monthly payments. Also during this time workers began working from home and many moved to the suburbs because they now did not need to commute to work, much was done by telecommuting. Much of the home building stopped, but people wanted to upgrade to larger homes; perhaps with a home office. US Median home prices surged from $322,600 in the 2nd quarter of 2020 to $408,100 in the 4th quarter of 2021. That is more than a 25% increase during the pandemic and national home prices have almost doubled since the 1st quarter of 2009. The FR a few days ago came out and warned that we may be in a “housing bubble”. The last time they issued this warning was in 2008, as the last bubble was beginning to burst.

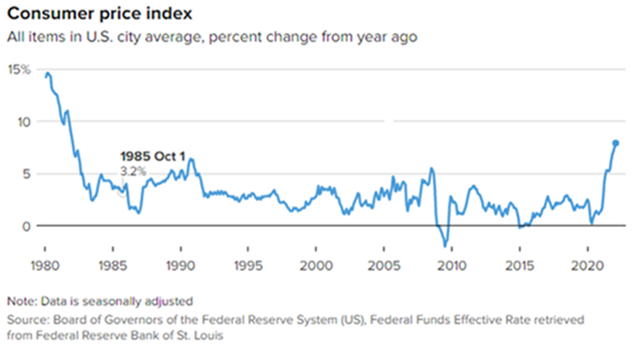

Along with home values rising dramatically, in the last year we have also seen consumer prices skyrocket at its fastest 12 month pace in 40 years. For instance, clothing prices, after plummeting in the early days of the pandemic, have risen 6.6% over the past year. Motor vehicle repair costs are up 6.3% and airline fares have jumped 12.7%. Rent of shelter costs, which make up nearly one-third of the Consumer Price Index, have been moving up sharply in recent months and are up 4.8% year over year. Prices are up 7.9% year over year, according to the consumer price index, which measures a wide-ranging basket of goods and services. Energy has been the biggest burden, as gasoline prices have risen 38% in the 12-month period (data from US bureau of labor and statistics)

Jim Baird, chief investment officer at Plante Moran Financial Advisors explains the possibilities: “Ultimately, they’ve come through with a clear message, that the Fed has a path forward to continue to tighten in response to this overwhelming concern around inflation. The question is, will it be enough and are they even recognizing that they’ve … perhaps fallen behind the curve? Will the path that they’ve laid out be enough to bring inflation back down to more comfortable levels in some reasonable time frame? The possibility certainly exists that they could get more aggressive.”

(Above chart shows Consumer price index trends. This is a visual way to understand how fast the price of average goods rise over a given period)

To fight off inflation the FR has announced it will raise the Fed funds rate 2% in 2022 and another .75% in 2023. “Changes to the federal funds rate might or might not move the rate on 10-year Treasury bonds, which are issued by the government take a decade to mature. Though a Fed rate (increase) doesn’t directly push (up) yields on the 10-year, it can lead to the same outcome. Investors worried about the economy after a rate (increase) might (move away from) the 10-year Treasury, considered a safe-haven asset, pushing (up) yields. The Fed also influences mortgage rates through monetary policy, such as when it buys or sells debt securities in the marketplace. Early in the pandemic there was severe disruption in the Treasury market, making the cost of borrowing money more expensive than the Fed wanted it to be. In response, the Federal Reserve announced it would buy billions of dollars in Treasuries and mortgage-backed securities, or MBS. The move was to support the flow of credit, which helped push mortgage rates to record lows.” Explains Zach Wichter from bankrate.com

The current FR rate increase is a dramatic shift in policy and is aimed at lowering the rising inflation. An effect of this policy might add to the cost to borrow. In California, the median home price in February 2022 was $771,270 A 20% down payment would be $154,254 and a loan amount of $617,016.

The effect of rate increases on mortgage payments:

(rates and payments are for illustrative purposes and cannot be guaranteed)

- In February 2022 the Average 30 year fixed rate was 3.76% (APR 4.048%) on a $617,016 loan amount that would be a Principle and Interest payment of $2,861/month.

- By the end of 2022 if that rate was be 1.9% higher to 5.66% (APR 5.852%) that would be a payment of $3,566/month.

- By the end of 2023 if that rate was another .75% higher to 6.41% (APR 6.612%) that would be a payment of $3,864/month.

Home Prices at different rates to keep the same mortgage payment

(rates and payments are for illustrative purposes and cannot be guaranteed)

- Of course our Average Rate was at a 3.76% (APR 4.048%) on a $617,016 loan amount which would be a Principle and Interest payment of $2,861/month.

- If the rate increases 1.9% in 2022, and at a rate of 5.66% (APR 5.852%) in order to maintain a principle and interest payment of $2,861/month the loan amount would be $495,200 and a purchase price of $619,000, a loss in purchase price of $152,270 from now.

- If the rate increases another .75% in 2023, and at a rate of 6.41% (APR 6.612%) in order to maintain a principle and interest payment of $2,861/month the loan amount would be $457,000 and a purchase price of $571,250, a loss in purchase price of $200,020 from now.

If the FR rate increases push up 30 year fixed mortgage rates, it may push home values down; if this were to happen, it would certainly lower a purchaser’s ability to buy a home at current prices. How much it will affect their willingness to pay is anyone’s guess.

Increased rates would also significantly affect the Reverse Mortgage (RM). The higher the interest rate, the less money a client will qualify for. If the home values were to drop that of course will also lower the amount of money a client may qualify for. RM qualification amortizations change constantly, but given the current data this would be the effect of different rates on RM qualification right now.

RM Qualification for Age 67, $500,000 home value at different Expected Rates

(rates and qualifications are for illustrative purposes and cannot be guaranteed)

- Current Expected Rate is 4.66% on a HECM monthly. Qualification would be $233,000

- Expected Rate 1% higher to 5.66% qualification would be $206,000 (Middle of 2022) This would result in $27,000 lower in money qualified for at this higher rate.

- Expected Rate another 1% higher to 6.56% qualification would be $182,500 This would result in $50,500 lower in money qualified for at this higher rate.

- Expected Rate another .75% higher to 7.31% qualification would be $169,000 This would result in $64,000 lower in money qualified for at this higher rate.

As you can see rate increases may have quite an impact on RM qualification amounts. You may consider if you should sell your home now, or maybe refinance and put money aside to purchase a home or invest in a future down market, or perhaps you should look into getting a RM now and take the higher qualification before it drops. Money can be kept in a RM line of credit and it currently is growing by around 4.5%, compounded annually. This money could be used later to purchase other properties or stocks and investments, at a discount, if the market were to fall. None of us knows what the future will hold, but a little bit of insight may help us prepare.

If you would like to look into accessing your home equity you may contact Robert Krepps rkrepps@hightechlending.com or toll-free at 877-567-7476.

Robert Krepps, NMLS #255191, at HighTechLending Inc. HighTechLending Inc, NMLS # 7147, is an Equal Housing Lender. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act.