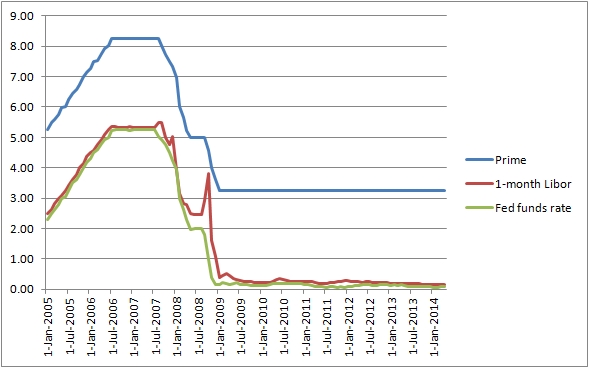

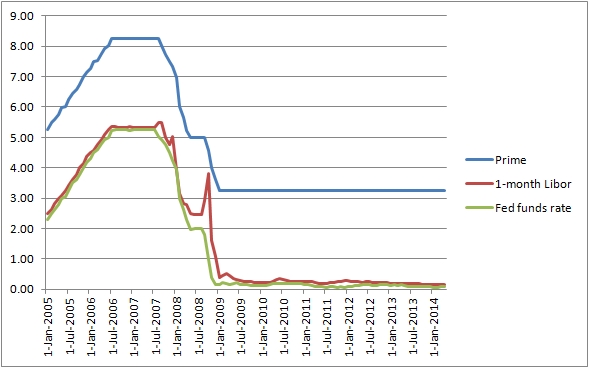

The US has enjoyed historic low interest rates for the better part of 9 years. But Yesterday the Federal Reserve Chair, Janet Yellen announced that the economy has strengthened, opening the way for her to raise the FED funds rate for the first time in almost a decade (effectively since July 2006, see chart below). Economists at Bloomberg anticipate Janet Yellen’s comments mean the Fed will begin raising its rates at ¼ of a percent.

For the tens of thousands of people considering a reverse mortgage, they may wonder how this reserve rate change will affect their qualification for a reverse mortgage. First, one must understand that the Federal Funds Rate is the rate that banks pay the Reserve or other banks for money borrowed overnight. Banks will pay these rates so they meet the minimum required reserves for them each day. The LIBOR rate, the amount banks charge each other for eurodollars on the London interbank market, follows very closely with the Federal Funds rate as US banks will borrow from the LIBOR if it is cheaper than the Federal Funds rate.

The HECM Annual, HECM Monthly, and HECM Fixed rates are based on the LIBOR rate or US treasury rates, the higher the rate, the lower the payout on a Reverse Mortgage. Given the relationship between the Federal Funds rate and the LIBOR rate previously explained, we will see that what a person will qualify for will drop, and could drop significantly as the Fed Funds Rate, the LIBOR, and the treasury rate increases over time.

As the Federal Funds and LIBOR rates rise, this will cause all interest rates to eventually rise. As interest rates rise, it will put downward pressure on home values. For example, a family looking to purchase a home with 20% down at a 5% rate would qualify for a 200,000 home, if the rates were to rise to 6% they would qualify for less than 180,000. Therefore, rising rates push home values to drop as buyers qualify for less. The reverse mortgage payout is based on the home value therefore a drop in value lowers the money one can get on a RM. For example, a 70 year old borrower would get $108,500 on their HECM Annual RM on a home valued at $200,000, this same borrower would get $97,500 on a home valued at $180,000, an $11,000 drop in their cash payout! If the interest rate were also to be higher, then the amount paid out on the RM would be even lower.

In short, the federal funds rate rising will lower potential RM clients’ cash payouts because of downward pressure on home values and rising rates; both negatively affect the money offered on this HUD guaranteed program. The good news is we still enjoy historic low rates today and home values are at 7 year highs. To see what you qualify for today, click HERE to use our Reverse Mortgage Calculator.

Robert Snow Krepps, NMLS #255191, at HighTechLending Inc, call today to discuss how a reverse mortgage may be able to help you (877) 567 – 7476 or rkrepps@hightechlending.com .

HighTechLending Inc, NMLS # 7147, is an Equal Housing Lender. Licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act.

Tags: aarp reverse mortgageare reverse mortgages safebank mortgage reversecalifornia reversecalifornia reverse mortgagecalifornia reverse mortgage lenderCalifornia Reverse Mortgagescan i get more money on a revers mortgage if rates lowercan i get more money on a reverse mortgage if rates risecan I talk to a reverse mortgage consultant face to facedo I have to pay homeowners insurance with a reverse mortgageeliminate mortgageeliminate mortgage paymentEliminate Mortgage PaymentsFHA reverse mortgagefinancial adviser reverse mortgagefinancial advisor reverse mortgageget rid of mortgageget rid of mortgage paymentshelp seniors with mortgagehelp seniors with mortgage loanhelp seniors with mortgage paymenthipoteca inversa descuentohipoteca inversa mas baratahipoteca inversa mas dinerohipoteca inversa menos de 62homeHow A Reverse Mortgage Workshow do i get more money on a reverse mortgagehow do rising rates affect a reverse mortgageHow reverse mortgage worksHow reverse mortgages workHow To Get Rid Of Your MortgageHUD reverse mortgagejanet yellen to raise fed funds ratelive inloan helplos angeles reverse mortgagelos angeles reverse mortgage lenderlowest price on reverse mortgagemortgage + robert wagnermortgage applicationmortgage helpmortgage lendermortgage program reversemortgages for seniorsmost competitive reverse mortgage companyno more mortgageno more mortgage paymentNo More Mortgage Paymentsno mortgage paymentsreputable reverse mortgage companyreversereverse annuity mortgagereverse equity mortgagereverse loanreverse mortgage 4th leg of retirement income stoolReverse Mortgage AAG scamreverse mortgage advantagesreverse mortgage annuityreverse mortgage applicationReverse Mortgage Arrowhead Credit Unionreverse mortgage baby boomerreverse mortgage bad creditReverse Mortgage bankreverse mortgage bank of americareverse mortgage bankruptcy okReverse Mortgage bargainreverse mortgage best servicereverse mortgage brokerReverse Mortgage Brokersreverse mortgage calculatorreverse mortgage calculator anonymousreverse mortgage calculator no personal informationreverse mortgage can I get an annuityreverse mortgage can I redoReverse Mortgage chart of feesReverse Mortgage ChaseReverse Mortgage cheapestreverse mortgage companyreverse mortgage consultantsReverse Mortgage customized servicereverse mortgage debtreverse mortgage disadvantagesreverse mortgage discountsReverse Mortgage discounts for seniorsReverse Mortgage DVDreverse mortgage effect on heirsreverse mortgage estate planreverse mortgage expertReverse Mortgage ExpertsReverse Mortgage face to faceReverse Mortgage factsReverse Mortgage feesreverse mortgage for buying 2nd homereverse mortgage for fixing up my homereverse mortgage for home remodelreverse mortgage for investingreverse mortgage for investment propertyReverse Mortgage for Law Enforcementreverse mortgage for manufactured home purchasereverse mortgage for manufactured homesReverse Mortgage for PoliceReverse Mortgage for Public Servantsreverse mortgage for seniorReverse Mortgage for Teachersreverse mortgage for those under 62Reverse Mortgage Free DVDreverse mortgage guaranteereverse mortgage habla espanolreverse mortgage happyReverse Mortgage HECMReverse Mortgage highest cash outReverse Mortgage highest payoutreverse mortgage highest payoutsreverse mortgage hipoteca inversareverse mortgage how long do I have to wait after bankruptcyreverse mortgage how long do I have to wait after short sale reverse mortgageReverse Mortgage husband is under 62Reverse Mortgage in AlpineReverse Mortgage in banningReverse Mortgage in BarstowReverse Mortgage in BeaumontReverse Mortgage in BonsallReverse Mortgage in CalimesaReverse Mortgage in Canyon Countryreverse mortgage in canyon lakeReverse Mortgage in CastaicReverse Mortgage in Cherry ValleyReverse Mortgage in City HeightsReverse Mortgage in ClairemontReverse Mortgage in CoachellaReverse Mortgage in CraftonReverse Mortgage in CrestlineReverse Mortgage in DescansoReverse Mortgage in Diamond BarReverse Mortgage in Eagle RockReverse Mortgage in El CerritoReverse Mortgage in Encantoreverse mortgage in fontanaReverse Mortgage in Grand TerraceReverse Mortgage in GrantvilleReverse Mortgage in HighlandReverse Mortgage in HomelandReverse Mortgage in IdyllwildReverse Mortgage in IndioReverse Mortgage in Joshua TreeReverse Mortgage in JurupaReverse Mortgage in La JollaReverse Mortgage in La MesaReverse Mortgage in La PresaReverse Mortgage in La QuintaReverse Mortgage in Laguna BeachReverse Mortgage in Lake ArrowheadReverse Mortgage in Lake Los AngelesReverse Mortgage in LakesideReverse Mortgage in LenwoodReverse Mortgage in Lucerne ValleyReverse Mortgage in MiramarReverse Mortgage in Moreno ValleyReverse Mortgage in National CityReverse Mortgage in NuevoReverse Mortgage in OrangecrestReverse Mortgage in Pear BlossomReverse Mortgage in PendletonReverse Mortgage in Pinon HillsReverse Mortgage in Quartz HillReverse Mortgage in Rancho BernardoReverse Mortgage in Rancho PenasquitosReverse Mortgage in Rancho Santa FeReverse Mortgage in Redlandsreverse mortgage in running springsreverse mortgage in san jacintoReverse Mortgage in San MarcosReverse Mortgage in San YsidroReverse Mortgage in Scripps RanchReverse Mortgage in Spring ValleyReverse Mortgage in Sunny SlopeReverse Mortgage in Tierra SantaReverse Mortgage in Torrey PinesReverse Mortgage in TustinReverse Mortgage in Universal CityReverse Mortgage in Valle LindoReverse Mortgage in WinchesterReverse Mortgage in WoodcrestReverse Mortgage in YucaipaReverse Mortgage in Yucca Valleyreverse mortgage inforeverse mortgage informationreverse mortgage insuranceReverse Mortgage lenderreverse mortgage line of creditreverse mortgage loanreverse mortgage localReverse Mortgage low feesReverse Mortgage lower IMIPReverse Mortgage lower Mortgage Insurancereverse mortgage lowest feesReverse Mortgage lowest pricereverse mortgage lump sumreverse mortgage monthly checkReverse Mortgage No Bankruptcy seasoningReverse Mortgage no short sale seasoningReverse Mortgage over 1 million valuereverse mortgage paymentsreverse mortgage payoutsreverse mortgage privacyreverse mortgage pros and consreverse mortgage protectionsreverse mortgage recommended by AARPreverse mortgage recommended by my doctorreverse mortgage refinancereverse mortgage refinance calculatorreverse mortgage refinance can I get more moneyreverse mortgage refinance highest payoutreverse mortgage refinance what are the rulesreverse mortgage refinancingreverse mortgage retireereverse mortgage retirement incomereverse mortgage run numbersreverse mortgage san diegoreverse mortgage savingsReverse Mortgage se habla espanolreverse mortgage short sale okreverse mortgage social securityreverse mortgage testimonialsReverse Mortgage toolreverse mortgage trustreverse mortgage wells fargoReverse Mortgage wife is under 62reverse mortgage will there be equity leftreverse mortgage world war 2 generationReverse Mortgage young spousereverse mortgages southern Californiariverside reverse mortgagesafest reverse mortgage companysenior loanstop forclosurewhat are reverse mortgage paymentswhen will fed raise rateswhen will interest rates rise